¶ Overview

A gateway must be created in order to process credit card payments in RevCent. You must have an existing merchant gateway account with a third party in order to create a RevCent gateway. If you do not have an existing merchant account, contact us and we can help you acquire one.

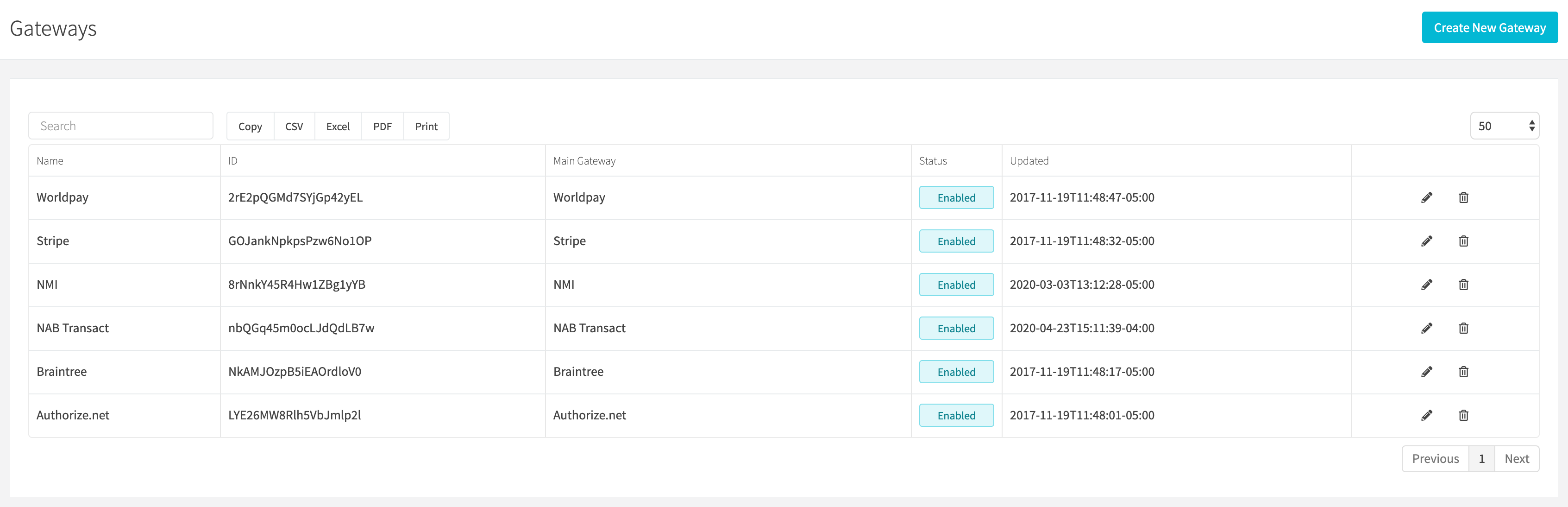

¶ View Gateways

View all gateways by clicking the Payments > Credit Card > Gateways link on the sidebar or going to https://revcent.com/user/gateways

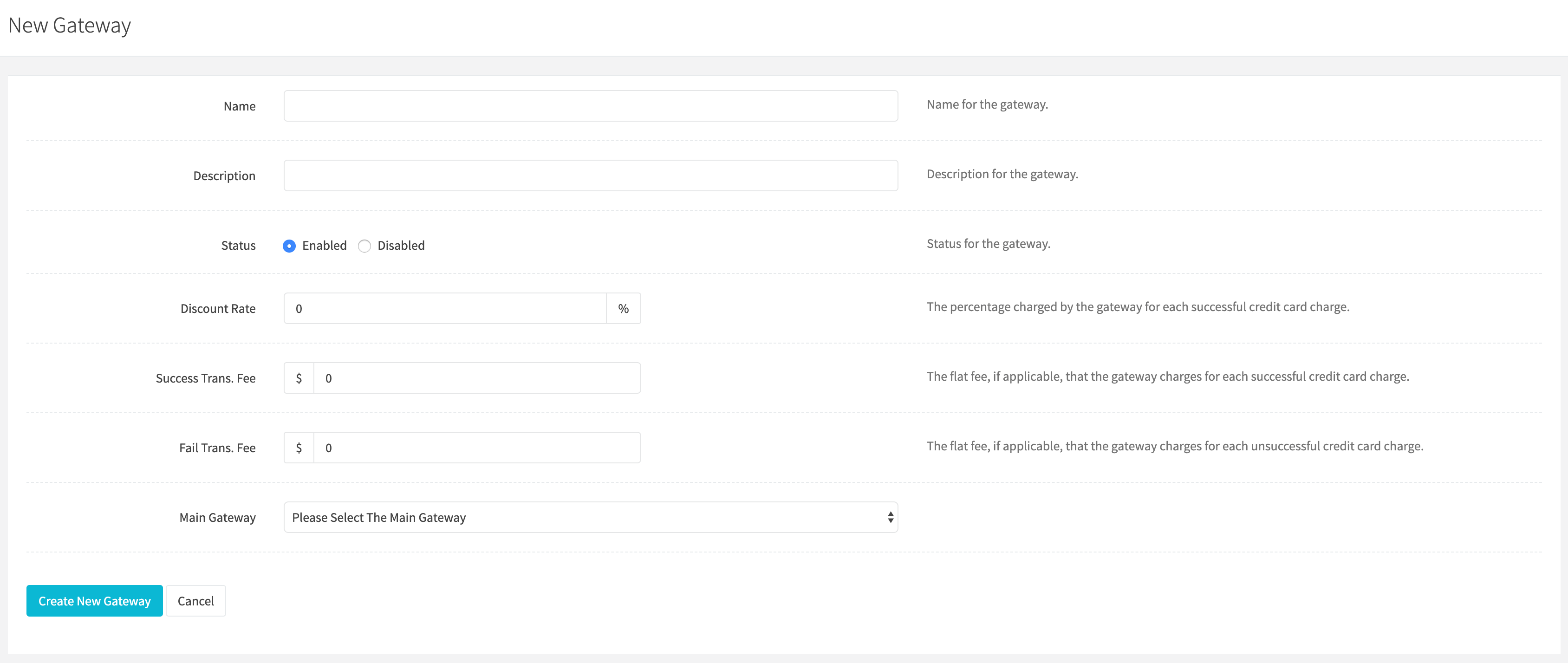

¶ Create A Gateway

Create a new gateway by clicking the Create New Gateway button when viewing all gateways or go to https://revcent.com/user/new-gateway

¶ Name

Enter a name for the gateway. Required and must be unique.

¶ Description

Enter a description for the gateway.

¶ Status

Set the status of the gateway.

¶ Discount Rate

The percentage charged by the gateway for each successful credit card charge.

¶ Success Transaction Fee

The flat fee, if applicable, that the gateway charges for each successful credit card charge.

¶ Failure Transaction Fee

The flat fee, if applicable, that the gateway charges for each unsuccessful credit card charge.

¶ Main Gateway

Select the main gateway you are using. Once selected, the gateway credentials box will appear.

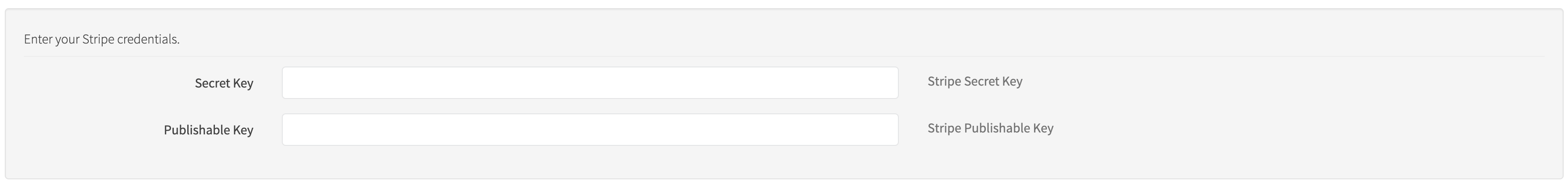

¶ Gateway Credentials

Depending on the merchant gateway selected, you will need to enter specific credentials. Credentials different for each merchant gateway. However, details are provided on the credentials you need. In the credential box above, Stripe was selected as the main main gateway.

Important: Enter the appropriate credentials depending on whether you wish to run live or test transactions using your gateway. You must also use the appropriate RevCent API Account that coincides with either live or test transactions.

Live/Test Example:

- Live Transactions: Enter your payments gateways' live credentials and also use a RevCent API Account that is set to live mode. By using a live RevCent API Account, RevCent will send transactions to your gateway's live endpoint.

- Test Transactions: Enter your payments gateways' test credentials and also use a RevCent API Account that is set to test mode. By using a test RevCent API Account, RevCent will send transactions to your gateway's test endpoint.

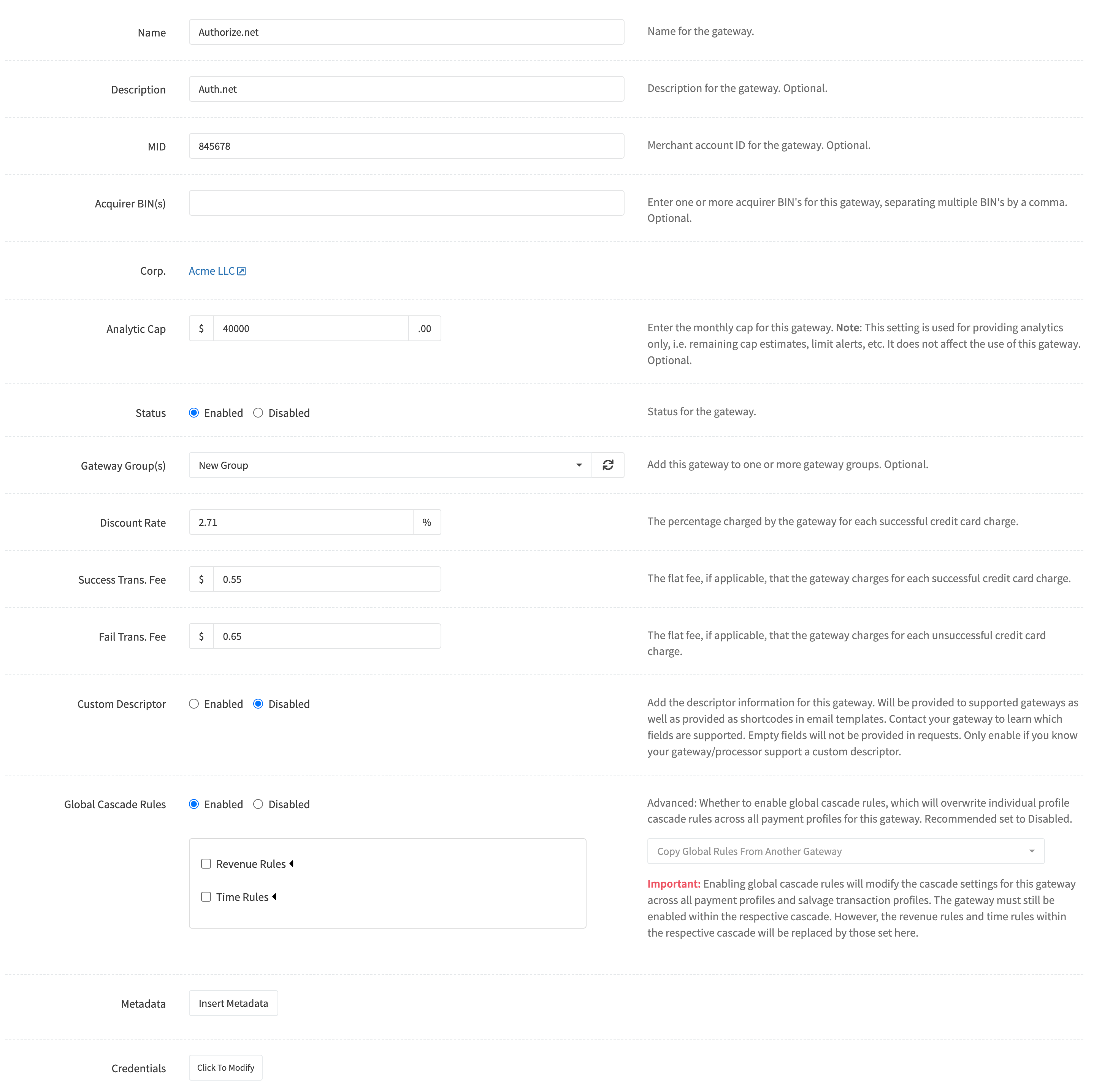

¶ Edit A Gateway

Edit an existing gateway by clicking the edit button when viewing all gateways.

¶ Details

¶ Name

Enter a name for the gateway. Required and must be unique.

¶ Description

Enter a description for the gateway.

¶ MID

Enter the merchant account ID specific to the gateway.

¶ Acquirer BIN

Enter one or more acquirer BIN's for this gateway, separating multiple BIN's by a comma. Optional.

¶ Analytic Cap

Enter the monthly cap for this gateway. Note: This setting is used for providing analytics only, i.e. remaining cap estimates, limit alerts, etc. It does not affect the use of this gateway. Optional.

¶ Status

Set the status of the gateway.

¶ Gateway Group

Add this gateway to one or more gateway groups. Optional.

¶ Discount Rate

The percentage charged by the gateway for each successful credit card charge.

¶ Success Transaction Fee

The flat fee, if applicable, that the gateway charges for each successful credit card charge.

¶ Failure Transaction Fee

The flat fee, if applicable, that the gateway charges for each unsuccessful credit card charge.

¶ Custom Descriptor

Add the descriptor information for this gateway. Will be provided to supported gateways as well as provided as shortcodes in email templates. Contact your gateway to learn which fields are supported. Empty fields will not be provided in requests. Only enable if you know your gateway/processor support a custom descriptor.

¶ Global Cascade Rules

Please read the Global Cascade Rules section below.

¶ Metadata

Insert custom name value pairs specific to the gateway. Optional.

¶ Credentials

If you wish to modify the existing credentials for the gateway, click the Modify button and the modify credentials box will appear

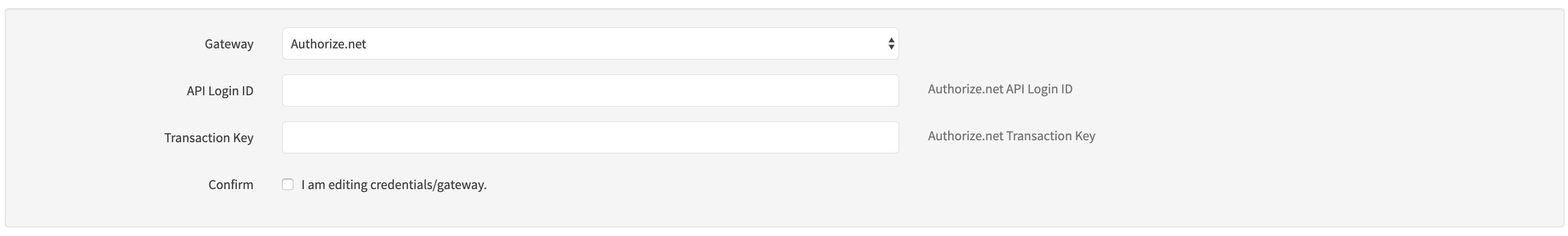

¶ Modify Credentials

Depending on the merchant gateway selected, you will need to enter specific credentials. Credentials different for each merchant gateway. However, details are provided on the credentials you need. In the credential box above, Authorize.net was selected as the main main gateway. Please note that you must select the Confirm checkbox if modifying credentials.

Important: Enter the appropriate credentials depending on whether you wish to run live or test transactions using your gateway. You must also use the appropriate RevCent API Account that coincides with either live or test transactions.

Live/Test Example:

- Live Transactions: Enter your payments gateways' live credentials and also use a RevCent API Account that is set to live mode. By using a live RevCent API Account, RevCent will send transactions to your gateway's live endpoint.

- Test Transactions: Enter your payments gateways' test credentials and also use a RevCent API Account that is set to test mode. By using a test RevCent API Account, RevCent will send transactions to your gateway's test endpoint.

¶ Global Cascade Rules

Global cascade rules will overwrite individual profile cascade rules across all payment profiles for this gateway. This is especially useful when using the Next-Gen Payment Profile instead of a basic profile.

¶ Revenue Rules

Revenue rules are specific to the gateway, and allow or disallow the use of the gateway based on payment volume, occurrences and more. You can add multiple revenue rules to a gateway. When creating a revenue rule, an explainer box will appear, explaining the rule that you have created based on the settings you chose.

¶ Enabled Checkbox

Whether the specific rule is enabled. If unchecked the rule will not apply.

¶ Bound

The rule bounds to declare if a rule passes or fails.

Options:

- Min: The final calculation value must be greater than the Rule Value.

- Max: The final calculation value must be less than the Rule Value.

¶ Rule Value

The rule value is compared with the calculation value and bound.

¶ Source

The source, in combination with the source value and calculation, is what is used to form the calculation value.

Options:

- This Gateway: Transactions only from the specific gateway the rule is within.

- All Gateways: All transactions regardless of gateway.

- Active Step: The active step being processed during the payment flow.

¶ Source Value

The source value is specific to the source selected.

Options:

- Captured Transactions: Only transactions which were captured.

- Declined Transactions: Only transactions which were declined.

- Charged Back Transactions: Only transactions which were marked as charged back.

- All Transactions: All transactions regardless of outcome or status.

- Step Amount: Applicable only when source is 'Active Step'. The amount for the active step being processed during the payment flow.

¶ Calculation

The calculation to perform based on the source value.

Options:

- Count: The total number of source value items.

- Percent: The percentage of source value items.

- Sum: The sum of all source value items.

¶ Time Value

The total amount of time the rule applies in a past time range.

¶ Time Unit

The time unit. Used in conjunction with the time value.

Options:

- Hour: Time value as hours.

- Day: Time value as days.

- Week: Time value as weeks.

- Month: Time value as months.

¶ Time Rules

Time rules are specific to the gateway, and allow or disallow the use of the gateway based on time settings. All time rules are GMT (UTC+0). You can add multiple time rules to a gateway.

¶ Enabled Checkbox

Whether the specific rule is enabled. If unchecked the rule will not apply.

¶ Day

The specific weekday that the time rule applies.

¶ Time Range

The time range the rule applies to for the day selected.

¶ Option

Whether to allow or deny the gateway from processing the step transaction based on the current GMT time and the rule day and time ranges.

Options:

- Allow: Allow the gateway to process the step transaction if current GMT time and day are within the day and time ranges.

- Deny: Do not allow the gateway to process the step transaction if current GMT time and day are within the day and time ranges.

¶ Advanced Settings

Important: We now recommend using a Next-Gen Payment Profile instead of advanced settings. Advanced settings are meant for the Basic Payment profile. However, the introduction of the Next-Gen Payment Profile has rendered advanced settings obsolete. If you are considering using advanced settings, we recommend you use a Next-Gen profile instead.

RevCent offers advanced settings for individual gateways. Note: Advanced settings only apply when it is an initial sale transaction or subscription renewal and a Payment Profile Cascade is used.

RevCent uses a scoring system to re-order gateways within a cascade if advanced setting options are selected and matched. RevCent totals the score for each enabled gateway within a cascade, based on all options selected. RevCent will re-order the cascade gateways based on the scores, highest first, but still keeping the payment profile step cascade order. If no gateways have an increased score, i.e. all have +0, then the original payment profile step cascade order is kept. Revenue and time rules still apply and may remove a gateway regardless of advanced setting score.

Advanced settings are a powerful tool and require an understanding of each advanced setting Type: currency, BIN, product group, and Type Options: Only, Prefer, Deny. If configured incorrectly, you can inadvertently prevent a gateway from ever processing a transaction, or always have a single gateway process all transactions. Please read carefully if you plan to implement advanced settings.

¶ Types

- Currency: The transaction currency.

- BIN: Any BIN profiles you wish to implement, used in comparison to the card BIN being used in the transaction.

- Product Group: Any product group(s) that contain products related to the transaction.

¶ Type Options

- Only: Restrict the gateway to be used if only selected options match transaction, ignoring Prefer matches.

- Prefer: If you want the gateway to have increased priority on matched selected options, but not be limited to only the selected options.

- Deny: If you want to prevent the gateway from being used if selected options match, ignoring Only and Prefer matches.

¶ Scoring

Each individual setting Type and Type Option have a different score associated for Only and Prefer. This gives you the ability to configure advanced settings in a way that allows maximum flexibility based on currency, BIN and product combined. Any Deny matches immediately remove the gateway from the cascade for the specific transaction, regardless of Only or Prefer matches.

Custom Scoring: The scoring table below are the default score values RevCent assigns. However, you have the ability to implement custom scores for Only and Prefer at the gateway level.

¶ Scoring Table

| Only Match | Only No Match | Prefer Match | Prefer No Match | Deny Match | Deny No Match | |

|---|---|---|---|---|---|---|

| Currency | +25 | gateway rejected | +1 | +0 | gateway rejected | +0 |

| BIN 8/6 | +15/+14 | gateway rejected | +4/+3 | +0 | gateway rejected | +0 |

| Product Group | +8 | gateway rejected | +1 | +0 | gateway rejected | +0 |

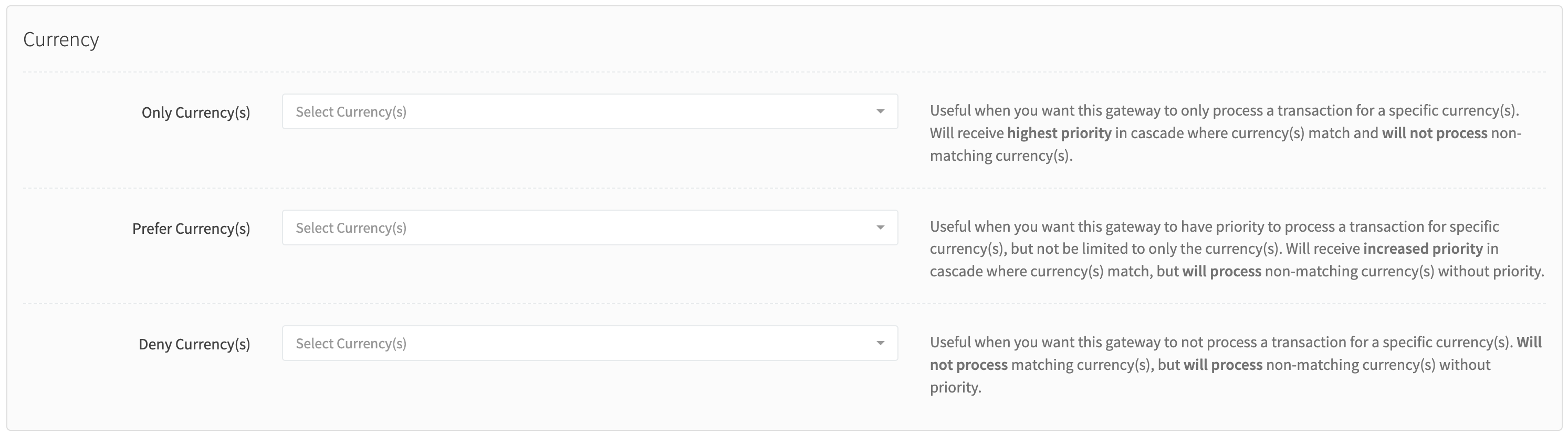

¶ Currency

Currency based gateway settings. Route to or prevent a gateway based on the transaction currency.

- Only Currency(s): Useful when you want a gateway to only process a transaction for a specific currency(s). Will receive +25 score in cascade where currency(s) match and will not process non-matching currency(s). +25 if matched. Gateway rejected if no match.

- Prefer Currency(s): Useful when you want a gateway to have priority for specific currency(s), but not be limited to only the currency(s). Will receive +1 score in cascade where currency(s) match, but will process non-matching currency(s) without score increase. +1 if matched, +0 if no match.

- Deny Currency(s): Useful when you want a gateway to not process a transaction for a specific currency(s). Will not process matching currency(s), but will process non-matching currency(s) without score increase. Gateway rejected if matched, +0 if no match.

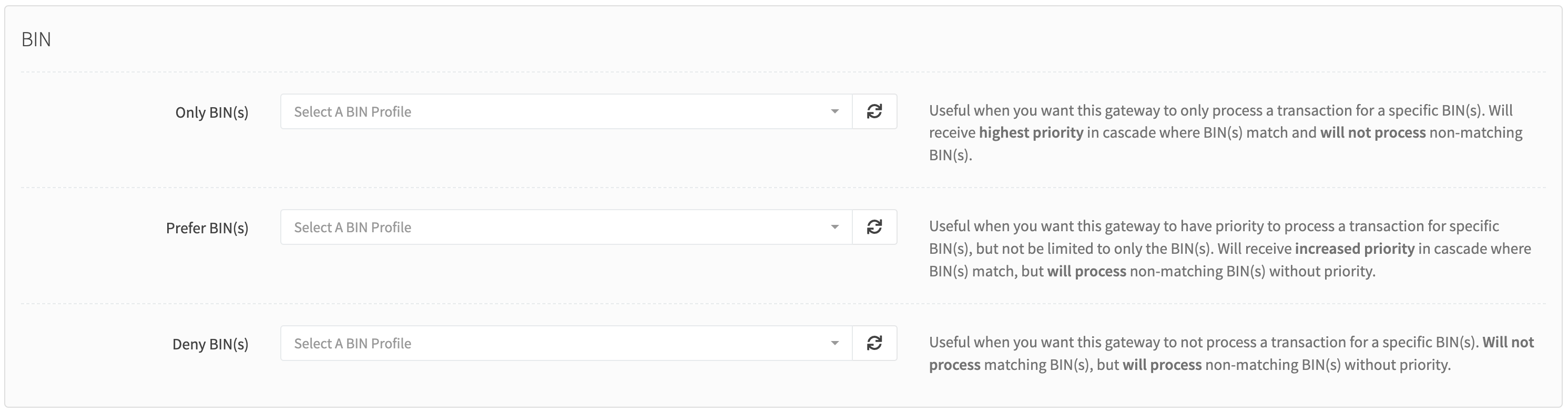

¶ BIN

Credit card BIN based gateway settings using BIN Profiles. Route to or prevent a gateway based on the first six or eight digits of the credit card being used.

- Only BIN(s): Useful when you want this gateway to only process a transaction for a specific BIN(s). Will receive +15 score for BIN8 and +14 score for BIN6 in cascade where BIN(s) match and will not process non-matching BIN(s). +15/+14 (BIN8/BIN6) if matched. Gateway rejected if no match.

- Prefer BIN(s): Useful when you want this gateway to have priority for specific BIN(s), but not be limited to only the BIN(s). Will receive +4 score for BIN8 and +3 score for BIN6 in cascade where BIN(s) match, but will process non-matching BIN(s) without without score increase. +4/+3 (BIN8/BIN6) if matched, +0 if no match.

- Deny BIN(s): Useful when you want this gateway to not process a transaction for a specific BIN(s). Will not process matching BIN(s), but will process non-matching BIN(s) without score increase. Score: Gateway rejected if matched, +0 if no match.

¶ BIN 8 vs 6

BIN Profiles allow you to specify individual BIN's, or a range of BIN's, for both BIN 8 and BIN 6. A BIN 8 match is given a higher score versus a BIN 6 match, as more digits matched the customers card. The distinction between BIN lengths allows granular routing, narrowing it down to institution.

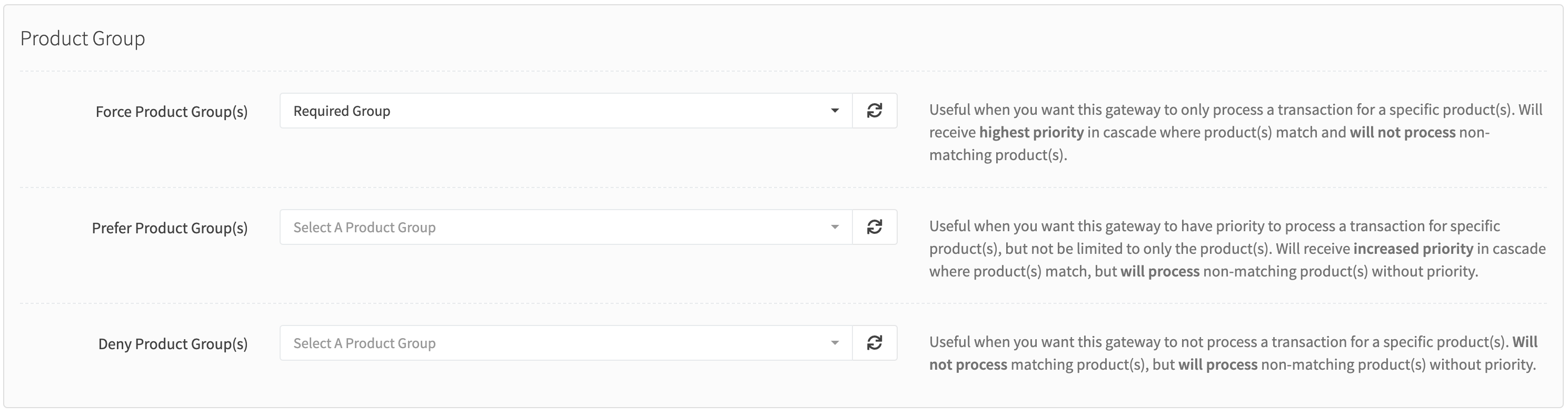

¶ Product Group

Product based gateway settings using Product Groups. Route to or prevent a gateway based on the product within a specific transaction.

- Only Product Group(s): Useful when you want a gateway to only process a transaction for a specific product(s). Will receive +8 score in cascade where product(s) match and will not process non-matching product(s). +8 if matched. Gateway rejected if no match.

- Prefer Product Group(s): Useful when you want a gateway to have priority for specific product(s), but not be limited to only the product(s). Will receive +1 score in cascade where product(s) match, but will process non-matching product(s) without score increase. +1 if matched, +0 if no match.

- Deny Product Group(s): Useful when you want a gateway to not process a transaction for a specific product(s). Will not process matching product(s), but will process non-matching product(s) without score increase. Score: Gateway rejected if matched, +0 if no match.

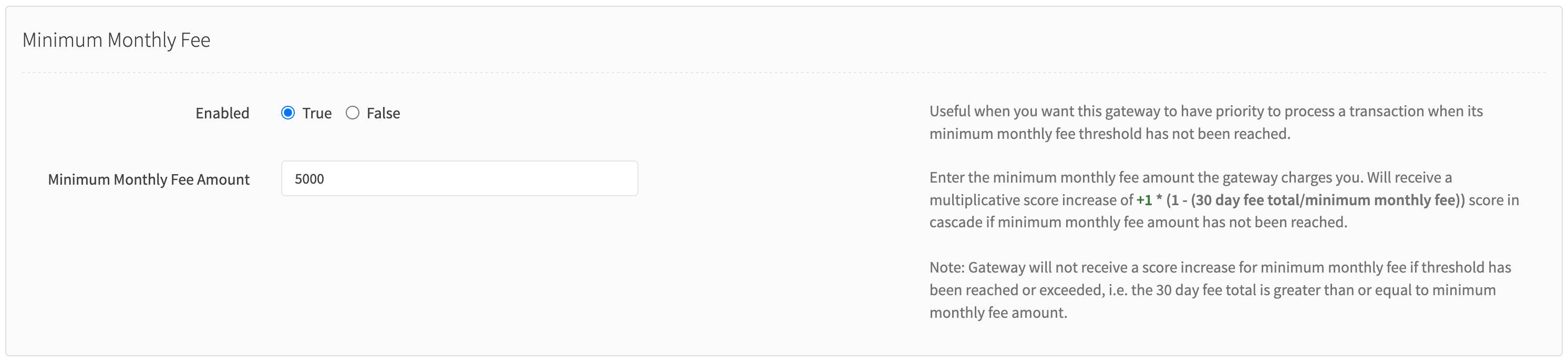

¶ Minimum Monthly Fee

Increase the score of a gateway based on the percentage remaining of monthly minimum fee total. Useful when you want to use a particular gateway if you are paying for fees up front. Will receive a multiplicative score increase of +1 * (1- (30 day fee total/minimum monthly fee)) score.

RevCent calculates the score based on the percentage amount of minimum fees remaining to be used. The greater the percentage remaining (1- (30 day fee total/minimum monthly fee)), the greater the score.

Note: Gateway will not receive a score increase for minimum monthly fee if threshold has been reached or exceeded, i.e. the current fee total is greater than or equal to minimum monthly fee amount.

- Enabled: Select whether to enable or disable the Minimum Monthly Fee advanced setting.

- Minimum Monthly Fee Amount: Enter the minimum monthly fee amount the gateway charges you.

¶ Example Score Calculations

Score Multiplier = 1

30 Day Fee Total = 2500

Minimum Monthly Fee Amount = 5000

Score Calculation = 1 * (1-(2500/5000))

Score Increase = +0.5

Score Multiplier = 1

30 Day Fee Total = 3500

Minimum Monthly Fee Amount = 5000

Score Calculation = 1 * (1-(3500/5000))

Score Increase = +0.3

Score Multiplier = 1

30 Day Fee Total = 5500

Minimum Monthly Fee Amount = 5000

Score Calculation = N/A The 30 Day total exceeded monthly minimum amount.

Score Increase = +0

¶ Available Gateways

If you don't see a gateway you need, let us know and we can integrate it.

| Name | 3DS v2 |

|---|---|

| Adyen | |

| Authorize.net | |

| Braintree | |

| Cardpointe | |

| Checkout.com | YES |

| Cybersource | |

| FluidPay | YES |

| Elavon Converge | |

| Maverick | |

| NAB Transact | |

| NMI | YES |

| Pathly | |

| PayJunction | |

| PaySafe | YES |

| PSiGate | |

| Pinwheel |

¶ 3DS Authentication

Some gateways offer the ability to utilize 3DS v2 authentication for payment transactions. You can implement 3DS v2 and use the RevCent API to send the 3DS v2 variables to an enabled gateway. Read more about 3D Secure 2

¶ How It Works

3DS v2 works via JavaScript code on your shopping cart/checkout page. When a customer clicks submit to complete payment, you first submit a request to the 3DS v2 endpoint to retrieve 3DS v2 authentication values/instructions. These values are then passed to the RevCent API, via the “three_ds” object when ready to process payment. RevCent will pass non-empty and non-null “three_ds” values to the payment gateway according to the specific gateways specification.

3DS v2 is not a plug and play solution, and requires a developer or someone with knowledge on JavaScript in the browser. Only specific gateways are supported, and each gateway requires their own browser implementation.

¶ API Request

To send RevCent the 3DS v2 values returned from the browser, do so using the “three_ds” object in the sale > create API call. Example: https://revcent.com/docs/api#sale-create-credit-card

Example Sale > Create request with 3DS v2 values in the “three_ds” object. Not all three_ds values are required, only the values returned in the browser from the gateways' 3DS v2 endpoint.

{

"request": {

"type": "sale",

"method": "create",

"three_ds": {

"enabled": true, // Required if sending 3DS values to RevCent.

"version": "2.2.0", // The 3DS version. Example: "2.1.0" or "2.2.0".

"eci": "05", // The eCommerce indicator. Indicates the result of the attempt to authenticate the cardholder.

"cavv": "Y2FyZGluYWxjb21tZXJjZWF1dGg", // Cardholder Authentication Verification Value

"xid": "YXV0aCB0eG4gaWRzIGFyZSBmdW4=", // The transaction identifier from authentication processing.

"directory_server_id": "3f6fb1f8-f719-46c9-905b-bab446f4de30", // A transaction identifier assigned by the directory server.

"authentication_response": "verified", // Describing if a customer was successfully verified or attempted. Example: "verified" or "attempted".

"acs_transaction_id": "d6f15aae-2c9d-4333-a920-954be07c0c76", // Access Control Server (ACS) transaction identifier.

"algorithm": "1", // 3DS algorithm used.

"directory_response": "Y", // 3DS directory server response.

"enrollment_response": "Y", // Verify enrollment response/status

"three_ds_server_transaction_id": "" // 3DS server transaction id.

"gateway_id": "" // Optional: Provide a specific RevCent gateway ID if 3DS values are specific to a gateway in RevCent. Otherwise do not include.

}

.....

}

}

¶ 3DS SDK Mapping

We have provided a few 3DS SDK examples below, with field mapping and links to instructions. If you are using an SDK not listed below, please make sure you map the correct fields from the SDK you are using.

Note: Each SDK returns specific fields to the browser upon 3DS v2 authentication. These fields are mapped to the RevCent field in the “three_ds” object. Therefore, when making the API call, the response fields from the browser 3DS v2 authentication request need to match the fields in the RevCent API call three_ds object according to the mapping table for each SDK below.

¶ PAAY 3DS SDK

PAAY is a third party service we recommend for easy 3DS integration.

| PAAY 3DS Response Field | RevCent API Field | Example Value |

|---|---|---|

| eci | eci | 05 |

| authenticationValue | cavv | Y2FyZGluYWxjb21tZXJjZWF1dGg |

| dsTransId | directory_server_id | 3f6fb1f8-f719-46c9-905b-bab446f4de30 |

| protocolVersion | version | 2.2.0 |

| acsTransId | acs_transaction_id | d6f15aae-2c9d-4333-a920-954be07c0c76 |

¶ NMI 3DS SDK

The NMI 3DS SDK response fields are shown below

| Gateway Response Field | RevCent API Field | Example Value |

|---|---|---|

| eci | eci | 05 |

| cavv | cavv | Y2FyZGluYWxjb21tZXJjZWF1dGg |

| xid | xid | OU9rcTRCY1VJTFlDWTFESXFtTHU= |

| directoryServerId | directory_server_id | 3f6fb1f8-f719-46c9-905b-bab446f4de30 |

| cardHolderAuth | authentication_response | verified |

| threeDsVersion | version | 2.2.0 |

¶ Paysafe 3DS SDK

The Paysafe 3DS SDK response fields are shown below

| Gateway Response Field | RevCent API Field | Example Value |

|---|---|---|

| eci | eci | 05 |

| cavv | cavv | AAABCIEjYgAAAAAAlCNiENiWiV+= |

| xid | xid | OU9rcTRCY1VJTFlDWTFESXFtTHU= |

| directoryServerTransactionId | directory_server_id | a3a721f3-b6fa-4cb5-84ea-c7b5c39890a2 |

| threeDResult | directory_response | Y |

| threeDEnrollment | enrollment_response | Y |

| threeDSecureVersion | version | 2.2.0 |

¶ Checkout.com 3DS SDK

The Checkout.com 3DS SDK response fields are shown below

| Gateway Response Field | RevCent API Field | Example Value |

|---|---|---|

| eci | eci | 06 |

| cryptogram | cavv | 123feb70-d16b-4da6-b07f-98c0 |

| xid | xid | 79f6205c-ff5c-4a4c-8fca-90f67f3a6470 |

| version | version | 2.2.0 |

¶ 3DS Pre-Purchase Gateway

You may wish to know the gateway which will be used prior to processing an initial sale. This is useful when using multiple 3DS SDK's and require a 3DS Key specific to a gateway in order to load the correct SDK within a browser.

This process involves a Sale Estimate API call to RevCent, with payment information or a customer ID with a saved card. RevCent will return a sale estimate which will include the gateway to be used when eventually performing a Sale Create API call. You will then use the gateway_id returned by RevCent for a Sale Create call, within the three_ds object.

Note: This is an advanced method and not necessary if you are not using 3DS, or only using a single 3DS SDK key in the browser during checkout.

Requirements

- Must be using a next-gen payment profile.

- Must provide payment information or a customer_id with a saved card in an estimate request.

- Must have sale:estimate permissions on the RevCent API account.

¶ Step 1 - Estimate A Sale

You will first estimate the sale, with payment information and an include_gateway: true within the request. The Sale Estimate call is similar to the Sale Create call, except no information is saved and no payment is processed. The estimate will run a next-gen payment profile flow to retrieve the gateway which will be used.

Things to note:

- No information is saved with estimating a sale.

- This is a mock call. Neither the customer, payment information or sale are saved within RevCent.

- A sale estimate request is only intended to return estimated and not definitive values.

- The estimate next-gen flow will also run Smart Bin if enabled for your account.

Example Request

Below is an example V1 API sale estimate request. If using the V2 API, refer to the V2 API sale estimate request.

{

"request": {

"type": "sale",

"method": "estimate", // make sure this is equal to "estimate".

"campaign": "Facebook Campaign",

"iso_currency": "USD",

"include_gateway": true, // required in order to return a gateway_id

"payment_profile": "next_gen_profile_id", // required and must be the ID to a next-gen profile in RevCent.

"payment": { // required if not providing a customer_id with a saved card, or the card has changed.

"credit_card": {

"card_number": "4000000000000002",

"exp_month": 11,

"exp_year": 42,

"card_code": "123"

}

},

"customer_id": "yRywYAJn1BsYnGpBrRl9", // required if not providing the payment object.

"customer": { // optional and can be used to find an existing customer with a saved card.

"first_name": "George",

"last_name": "Washington",

"email": "georgew@whitehouse.gov",

"address_line_1": "1600 Pennsylvania Ave",

"address_line_2": "West Wing",

"city": "Washington",

"state": "DC",

"zip": "20500",

"country": "USA",

"company": "Acme Inc.",

"phone": "1234567890"

},

"product": [ // required when making a sale estimate request.

{

"id": "av_2017"

}

]

}

}

¶ Step 2 - Estimate Response Gateway ID

The Sale Estimate call will return a gateway object, with the gateway_id. This is the gateway which will be used specific to the payment information provided when creating a sale. Any metadata saved for the specific gateway will be returned as well. You can use this metadata to save 3DS keys for a specific gateway.

Things to note:

- If a gateway isn't chosen the gateway object will not be returned.

- If you want gateway metadata returned, it must be previously saved within RevCent when editing a gateway.

Example Response

Below is the API response returned for a sale estimate request. You will check for the gateway object with an id property.

{

"code": 1,

"gateway": {

"id": "NkAMJOzpB5iEAOrdloV0", // the gateway ID to be used in a subsequent three_ds object when creating a sale.

"name": "Braintree",

"metadata": [ // metadata specific to the gateway in RevCent, if previously saved.

{

"name": "3ds_api_key",

"value": "XXXX"

}

]

},

... // remaining response fields redacted for brevity.

}

¶ Step 3 - Create A Sale

When you are ready to create the sale with a gateway specific to a 3DS authorization, you will include the gateway_id within the three_ds object. This will tell RevCent to prefer a specific gateway when processing payment within a next-gen profile.

Things to note:

- You must provide the gateway_id within the three_ds object.

- You must use a next-gen payment profile.

- The gateway_id will be preferred, and not forced within a next-gen profile flow.

- The gateway provided may not be used if the sale create next-gen flow rejects the gateway. A sale will not be declined if the gateway_id is rejected by the next-gen flow, instead another gateway will be used.

Example Request

Below is an example V1 API sale create request. If using the V2 API, refer to the V2 API sale create request.

Important: Include the gateway_id within the three_ds object, not outside the three_ds object.

{

"request": {

"type": "sale",

"method": "create",

"payment_profile": "next_gen_profile_id", // must be a next-gen profile.

"three_ds": { // Provide the gateway_id within the three_ds object.

"enabled": true, // Required if sending 3DS v2 values to RevCent.

"gateway_id": "" // Provide the returned RevCent gateway_id.

... // remaining 3DS fields redacted for brevity.

},

...

}

}