¶ Tax

RevCent offers the ability to calculate tax based on US ZIP codes or calculate tax using a third party vendor. Simply create a tax profile specifying whether to use our internal ZIP code calculation or a third party vendor.

¶ View Tax

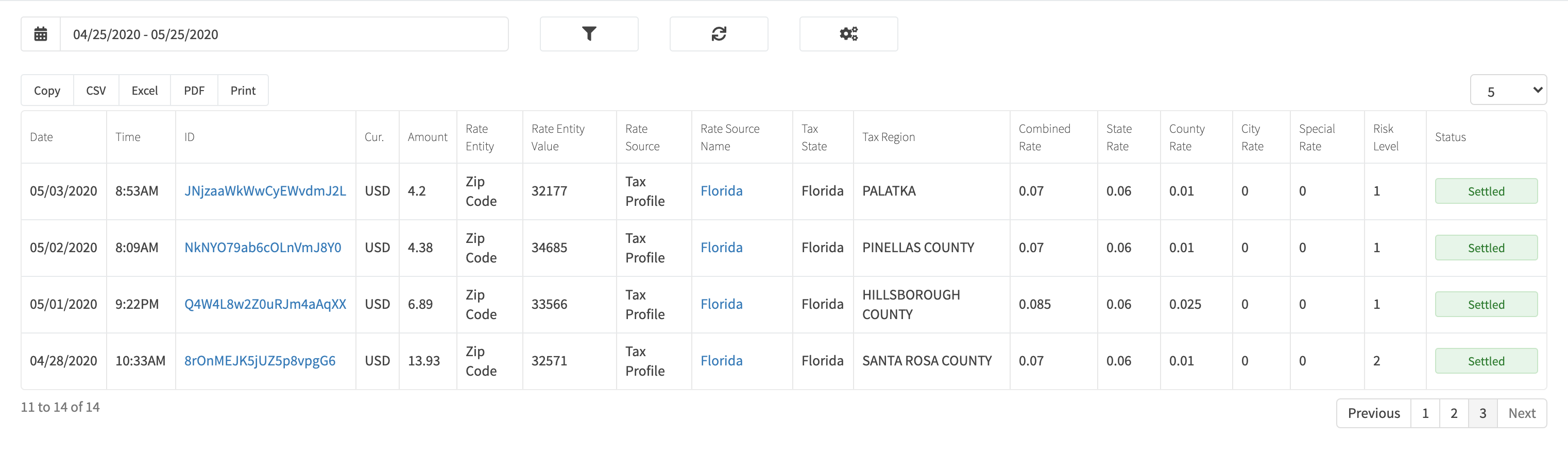

View all tax by clicking Revenue > Tax > All Tax in the sidebar or go to https://revcent.com/user/tax

¶ Tax Details

View tax details by searching for the tax in the top navigation search box, or clicking on the tax ID when viewing all tax.

The tax details page will display all related entities of the tax, i.e. sale, product sales, etc.

¶ Tax Profile

A tax profile in RevCent is a collection of tax rates organized by state and state zip codes. You can enable all US states, specific US state(s) as well as specific ZIP codes within a state(s).

When a purchase is made, RevCent will compare the customer ZIP code to any enabled tax profiles in your account. If the customer ZIP code matches a ZIP code within a tax profile, then RevCent will use the estimate combined tax rate for that ZIP code.

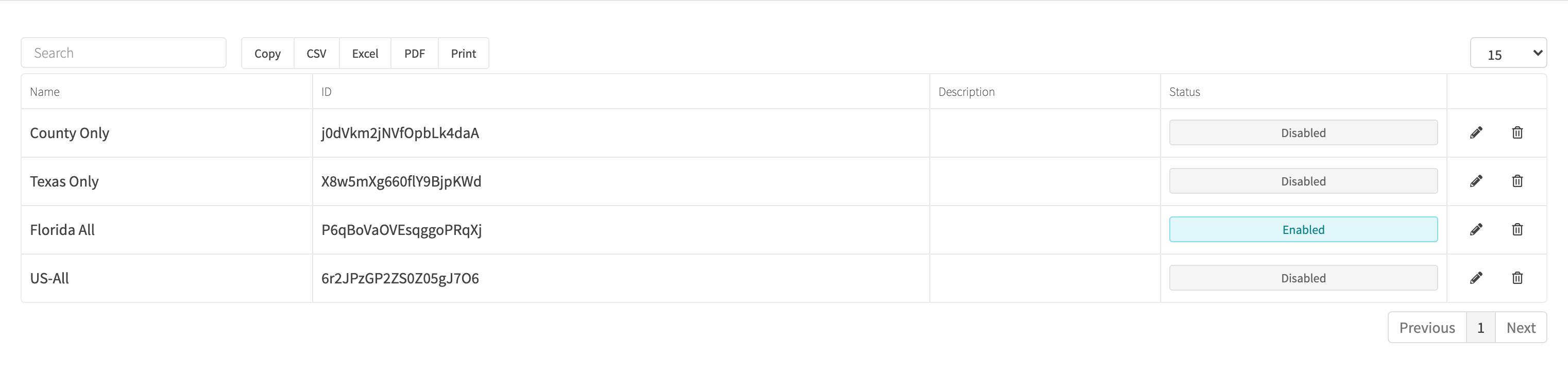

¶ View Tax Profiles

View all tax profiles by clicking the Revenue > Tax > Profiles link on the sidebar or going to https://revcent.com/user/tax-profiles

¶ Create Or Edit A Tax Profile

Create a new tax profile by clicking the Create New Tax Profile button when viewing all tax profiles or go to https://revcent.com/user/new-tax-profile

Edit an existing tax profile by clicking the edit button when viewing all tax profiles.

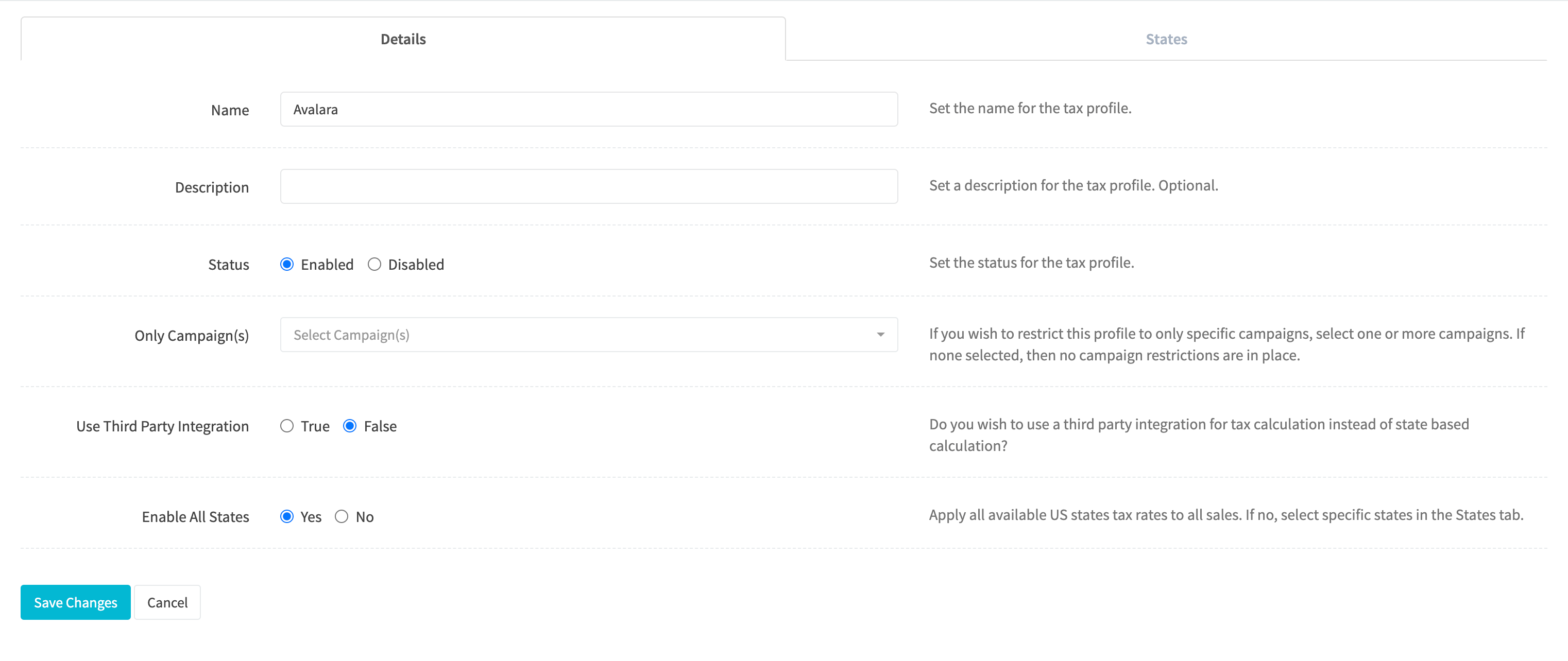

¶ Tax Profile Details

¶ Name

Enter a name for the tax profile. Required.

¶ Description

Enter a description for the tax profile.

¶ Status

Set the status of the tax profile.

¶ Only Campaign(s)

If you wish to restrict this profile to only specific campaigns, select one or more campaigns. If none selected, then no campaign restrictions are in place. Useful for separating different business based on tax regions, etc.

¶ Use Third Party Integration

If you wish to use a third party integration for tax calculation. You will need to have previously set up a third party integration that is tax based. Ex: Avalara.

¶ Enable All States

Apply all available US states tax rates to all sales. If no, select specific states in the States tab.

¶ Third Party Integration

If you wish to use a third party integration, instead of the US state based zip code calculation within RevCent, you will need to first create a third party integration, then select the third party integration from the list of integrations.

- Select Use Third Party Integration.

- Select your third party integration that is meant for tax calculation.

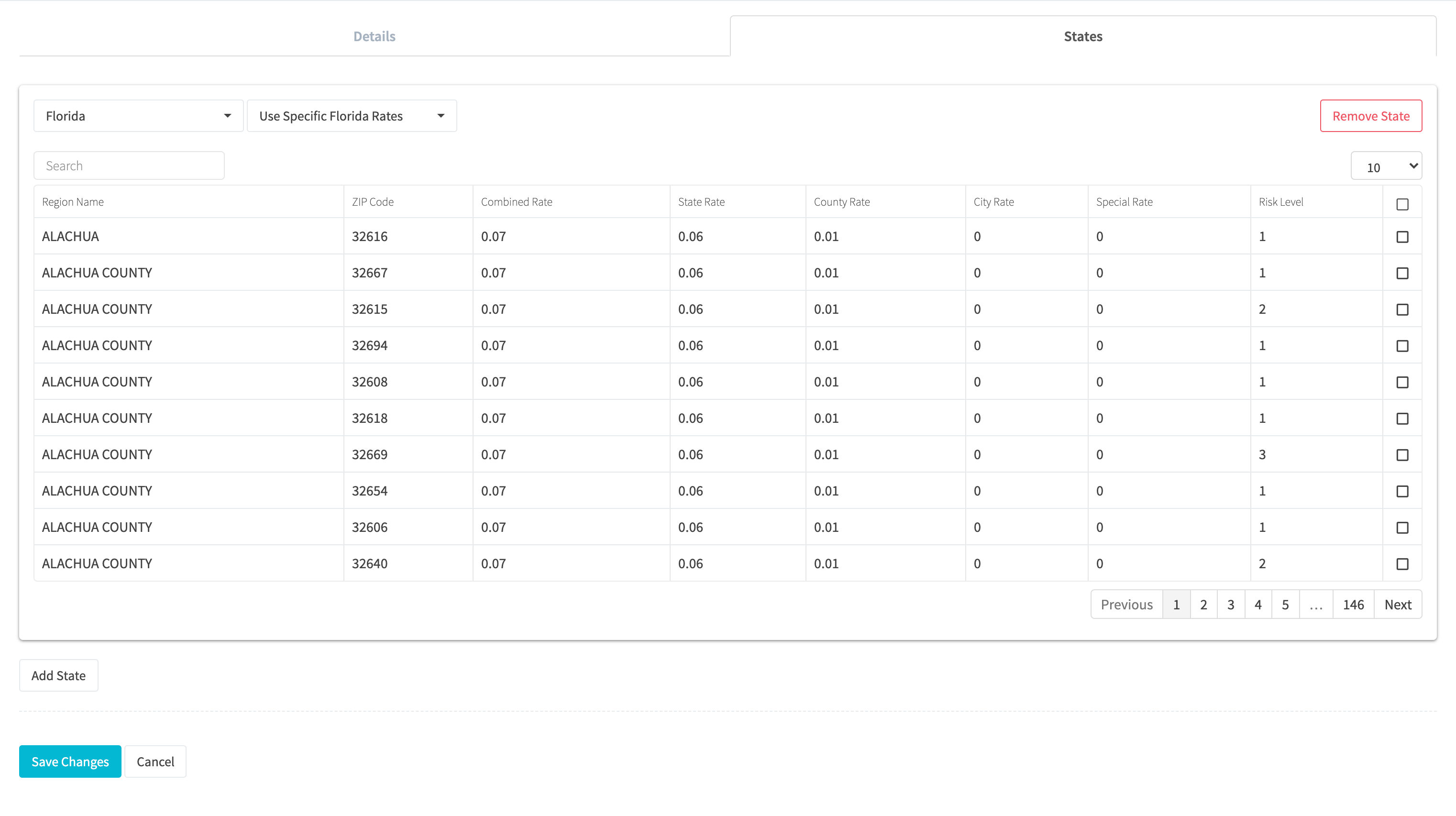

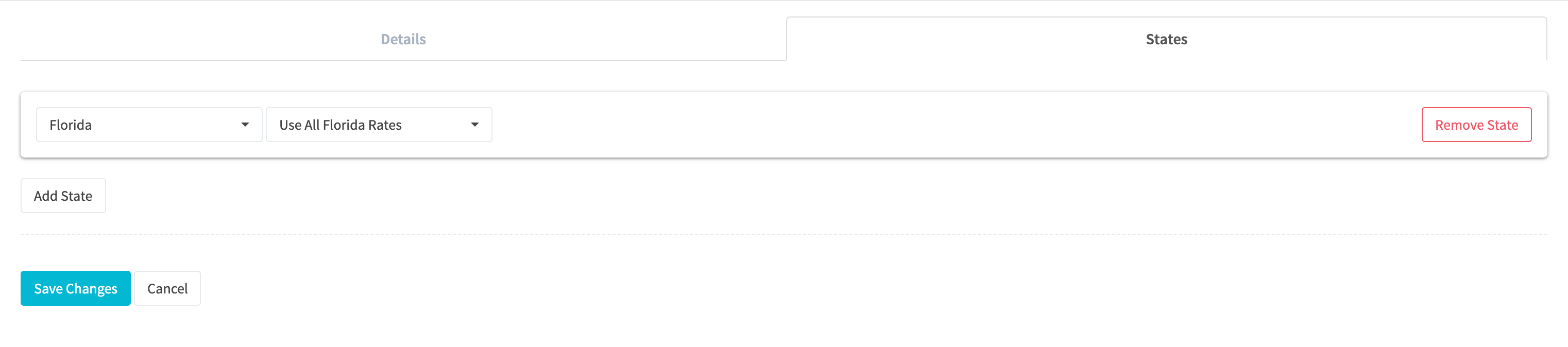

¶ Tax Profile States

You can add multiple states for US state based zip code calculation when estimating or creating sales, renewals, etc.

- Click the Add State button to include a state in your tax profile.

- Select a State.

- Select whether to apply taxes to all ZIP codes or specific ZIP codes within the state selected in step 2.

¶ Example: Use All Rates

¶ Example: Use Specific Rates

When using specific rates within a state, select the ZIP code by clicking the checkbox in the last column for each row (ZIP code) which you want to apply tax.

RevCent uses the value in the Combined Rate column for calculating tax on a sale. The tax rate for a ZIP code cannot be customized at this time.